How worried should we be over the shock rise in inflation?

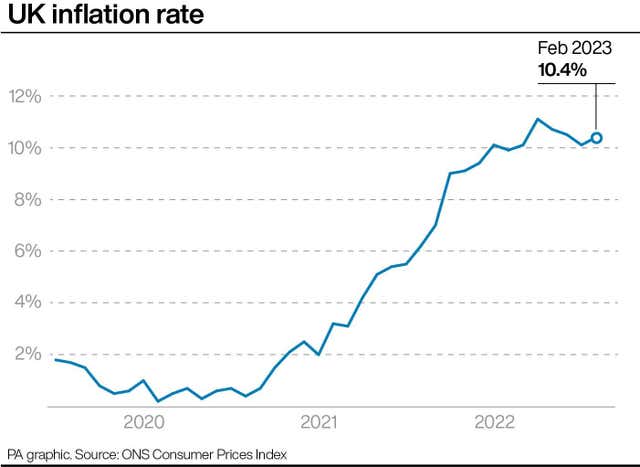

The Office for National Statistics data defied forecasts for a drop to 9.9% last month, instead revealing a rise back up to 10.4%.

The surprise increase in the rate of inflation last month has confirmed that the cost-of-living crisis is far from over for British households and businesses.

The data from the Office for National Statistics (ONS) defied forecasts for a drop in the Consumer Prices Index (CPI) last month, instead revealing a rise back up to 10.4% from 10.1% in January.

It comes after three straight months of declining inflation, which had seen hopes mount that the worst of the crisis was behind us and that the era of double-digit inflation was coming to an end.

So what was behind the unexpected increase and should we be worried that the cost crisis is ramping up again?

– Why was inflation in February so much higher than expected?

Economists were firmly pencilling in another drop, to 9.9% last month and have been taken aback by the surprise increase.

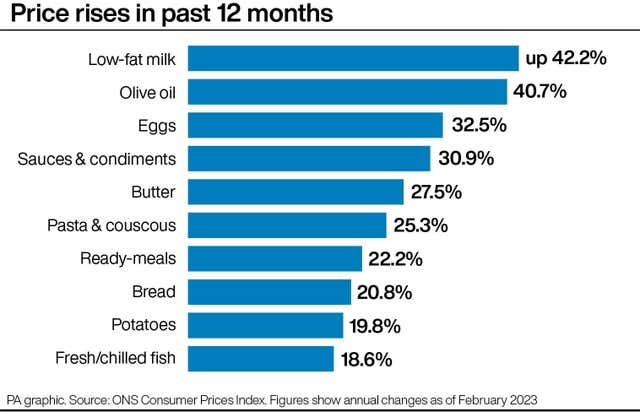

The rise comes after food prices leapt up by 18.3% year-on-year in February, driven largely by the salad and vegetable shortages seen across supermarkets in recent weeks.

Tomatoes, peppers and cucumbers were some of the vegetables impacted, with retailers saying a combination of bad weather and related transport problems in north Africa and Europe were causing significant supply problems.

The ONS said the rate of vegetable price inflation alone jumped to 18%, its highest level for 14 years.

– But experts knew about the pressure on food prices from last month’s shortages, didn’t they?

Economists had forecast a jump in food inflation, but nowhere near the 18.3% increase announced by the ONS.

There were also other factors behind the leap in CPI, with the ONS noting the rocketing cost of alcoholic drinks in pubs and restaurants as prices ticked up after discounts in January.

Inflation overall in restaurants and cafes stood at 11.4% last month, up from 9.4% in January and the highest since December 1991, with the hospitality sector more widely upping prices in the face of soaring energy and wage bills.

Higher clothing prices were another factor pushing up CPI, with this category seeing an 8.1% jump – the biggest for four months – with womenswear particularly seeing big rises.

– Do we need to be worried that the cost-of-living crisis is ramping up again?

Experts still believe that inflation will fall back sharply by the end of 2023.

The vegetable shortage has already largely resolved, suggesting food price inflation will ease off from March onwards.

There are also some prices that are dropping back considerably, for example at the fuel forecourts, where petrol and diesel are much lower than this time last year after Russia’s invasion of Ukraine.

Inflation is due to drop further as last year’s rocketing energy increases fall out of the calculation, while more widely, wholesale gas and electricity prices are easing back sharply.

The Bank of England believes inflation will more than halve by the year end, thanks to falling wholesale energy costs while supply chain disruption is also easing up.

Meanwhile, the UK’s fiscal watchdog, the Office for Budget Responsibility, last week cut its forecasts for inflation, predicting CPI would end the year at around 2.9%.

– What does this all mean for interest rates?

The Bank of England is set to announce its latest decision on Thursday, having already raised rates 10 times in a row, to 4% last month, in an effort to rein in soaring prices.

Recent turmoil in financial markets due to fears of a global banking crisis has led some experts to believe it will hold fire on another rise this month.

But the surprise rise in CPI will make it a more difficult decision, with others pencilling in another quarter point rise, to 4.25%, as they believe the Bank will prioritise its battle with inflation.