Interactive on the move after bank investment

Wolverhampton-based supplier of computer equipment for schools, Interactive Education Solutions, has moved into new larger premises in the city following an investment of £250,000 from Lloyds Bank Commercial Banking.

The move has seen the firm relocate to the Pendeford Business Park, where it has acquired two buildings to make up its new 4,000 sq ft premises, whilst still retaining its current headquarters at Libra House on Upper Zoar Street.

With new offices, the firm is now looking to achieve its growth ambitions by adding new members of staff to its team, whilst continuing to invest in its innovation centre, which will also relocate to the new building, where its products are developed.

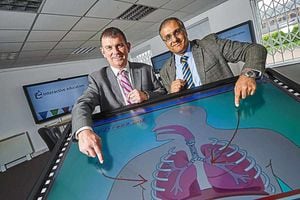

Founded in 2000, Interactive Education Solutions specialises in interactive information and communications and audio visual technology for schools across the UK, including interactive touch screens and tables, and curriculum based and presenting software.

The purchase of the new premises was aided by Lloyds Bank's participation in the Government backed Funding for Lending Scheme, which offers competitively priced lending to small and medium-sized enterprises in all sectors for the life of their loans. Ranjit Singh, director of Interactive Education Solutions, said: "We're pleased to have moved into new and larger premises, a move that's essential to enable us to achieve our goal of expanding our team, as well as increasing our focus on research and development of new products.

"Through the Lloyds Bank investment, we are looking ahead to the future, and will ensure that we remain at the cutting edge when it comes to providing interactive equipment to the education sector."

Philip Rowley, relationship manager at Lloyds Bank Commercial Banking, said: "Interactive Education Solutions Limited is a great example of the type of ambitious local business we are proud to support, and our participation in the Government's Funding for Lending scheme means the firm will reap the benefits of competitively priced lending as it aims to achieve continued growth.

"In 2014, we saw a £1 billion net increase in lending to small and medium sized businesses, and we have made a further commitment to invest an extra £3 billion net by the end of 2017."