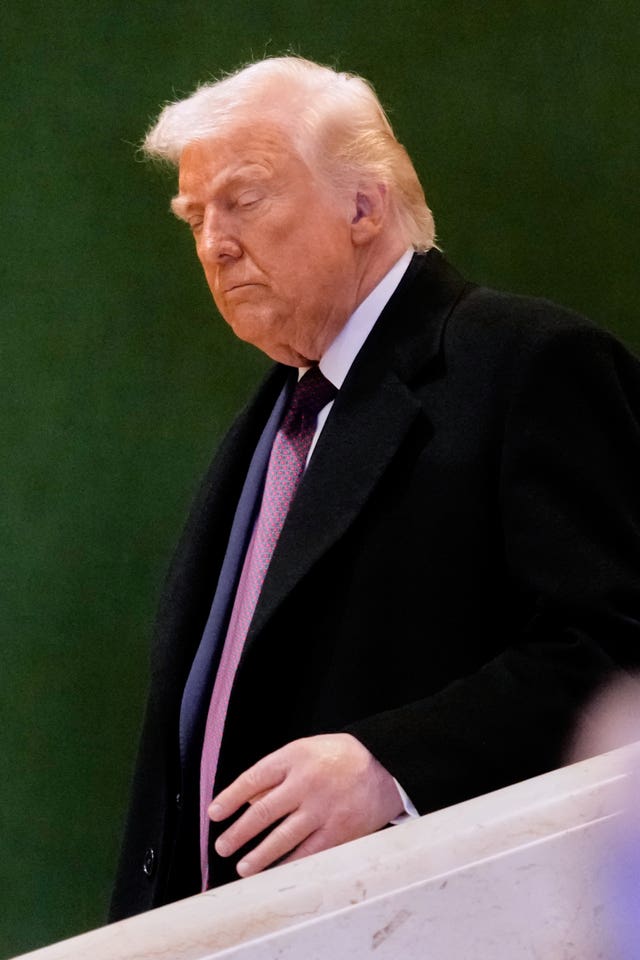

Trump sues JP Morgan Chase for ‘debanking him for political reasons’

The lawsuit has been filed in Miami-Dade County court in Florida.

Donald Trump is suing banking giant JP Morgan Chase and its chief executive Jamie Dimon for five billion dollars (£4bn), accusing the firm of debanking him and his businesses for political reasons after he was voted out of office in January 2021.

The lawsuit, filed in Miami-Dade County Court in Florida, alleges that JP Morgan abruptly closed multiple accounts in February 2021 with just 60 days’ notice and no explanation.

By doing so, Mr Trump claims JP Morgan cut the ex-president and his businesses off from millions of dollars, disrupted their operations and forced the Republican urgently to open bank accounts elsewhere.

“JPMC debanked (Trump and his businesses) because it believed that the political tide at the moment favoured doing so,” the lawsuit alleges.

In the lawsuit, Mr Trump alleges he tried to raise the issue personally with Mr Dimon after the bank started to close his accounts, and that Mr Dimon assured Mr Trump he would probe what was happening.

The lawsuit alleges Mr Dimon failed to follow up with Mr Trump. Further, Mr Trump’s lawyers allege that JP Morgan placed the president and his companies on a reputational “blacklist” that both JP Morgan and other banks use to keep clients from opening accounts with them in the future.

In a statement, JP Morgan said that it “regrets” that Mr Trump sued them but insisted they did not close the accounts for political reasons.

“We believe the suit has no merit,” a bank spokesperson said. “JPMC does not close accounts for political or religious reasons. We do close accounts because they create legal or regulatory risk for the company.”

Mr Trump threatened to sue JP Morgan Chase last week at a time of heightened tensions between the White House and Wall Street.

The president said he wanted to cap interest rates on credit cards at 10% to help lower costs for consumers. Chase is one of the largest issuers of credit cards in the country and a bank official told reporters that it would fight any effort by the White House or Congress to implement a rate cap on credit cards.

Bank industry executives have also bristled at Mr Trump’s attacks on the independence of the Federal Reserve.

Debanking occurs when a bank closes the accounts of a customer or refuses to do business with a customer in the form of loans or other services.

Once a relatively obscure issue in finance, debanking has become a politically charged issue in recent years, with conservative politicians arguing that banks have discriminated against them and their affiliated interests.

Debanking first became a national issue when conservatives accused the Obama administration of pressuring banks to stop extending services to gun stores and payday lenders under “Operation Choke Point”.

Mr Trump and other conservative figures have alleged that banks cut them off from their accounts under the umbrella term of “reputational risk” after the January 6 2021 attack on the US Capitol.

Since Mr Trump came back into office, the president’s banking regulators have moved to stop any banks from using “reputational risk” as a reason for denying service to customers.

“JPMC’s conduct … is a key indicator of a systemic, subversive industry practice that aims to coerce the public to shift and re-align their political views,” Mr Trump’s lawyers wrote in the lawsuit.

Mr Trump accuses the bank of trade libel and accuses Mr Dimon himself of violating Florida’s Unfair and Deceptive Trade Practices Act.