£17 million money laundering gang jailed after huge daily Post Office deposits

Two Birmingham-based criminals have been locked up for their part in laundering £17 million that was made from criminal operations.

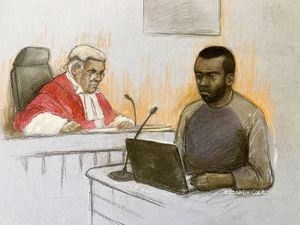

Shazad Jahan, aged 45, from Bordesley Green, and Sajid Nawaz, aged 59, from Kitts Green, were part of a four-man gang that deposited 'vast amounts' of cash into bank accounts.

The men would make more than 10 visits a day to different Post Office branches, at times depositing up to £200,000 a day, before the cash was moved into other accounts.

Officers from West Midlands Police's Regional Economic Crime Unit worked with partners including the Post Office, various banks and the National Crime Agency during the lengthy operation, with records showing that the deposits were made between 2021 and 2022.

Following the money trail, police enquiries led them to uncover the "professionally organised" group of criminals, with evidence showing that up to £17m in cash had been laundered in just one year.

The two men were finally arrested in June 2021 at a Birmingham Post Office branch.

Nawaz was found with £15,000 in a carrier bag, and a further £85,000 was found in a cardboard box in the vehicle he was travelling in.

Nawaz was holding one of the bank cards to one of the company accounts that was used to launder the money, as well as a mobile phone, which was open to a WhatsApp group chat called 'Action'.

The 'Action' chat was found to give details of Post Office locations and the amounts that should be deposited at each location.

Further enquiries also established that Jahan was directing the operation and set up the WhatsApp group, and was giving depositing instructions.

He was also found to have accessed the bank account online and transferred the money out of the account and into another business account.

In May 2022, officers carried out two warrants at addresses that were linked to him, and he was later arrested at Birmingham Airport on his return from a trip to Dubai.

His phone was found to contain logins for the company bank accounts where the money was deposited, and also login details for the accounts to which the money was transferred.

Another man, Naveed Gul, aged 47, of Western Avenue, Peterborough, was also identified as being a director of one of the companies used for money laundering, and the only account holder of the business bank account through which more than £2.5m was deposited and transferred.

Despite denying any knowledge of money going into and out of the account, investigators were able to prove his involvement.

The force said that officers recovered a 'large amount' of illicit cash as a result of the investigation, including £867,000, which was forfeited after eight accounts were frozen.

Along the way, a new crypto exchange based in London, which was laundering the proceeds of crime, was forced out of business.

An organisation which provided the group with a banking platform was also said to have collapsed into administration following a referral to the Financial Conduct Authority.

In addition, £100,000 cash was seized when the men were arrested, and another £9,000 in cash was found in searches of their addresses.

Shazad Jahan was jailed for five years and five months.

Naveed Gul was jailed for four years and three months.

Sajid Nawaz was given a two-year prison sentence, suspended for two years.

Senior investigating officer Jonathan Jones said: "These sentences are a result of a lengthy and complex investigation, and they show that we don’t give up.

“We estimate that a total of around £17m in cash was laundered in just one year – an extraordinary amount of money.

“The group may have thought they could get away with it, but our investigators stuck to the trail of the money and uncovered a series of businesses set up for the purposes of layering illicit funds.

“Working with a range of private and public partners, we’ve been able to seize and forfeit around £976,000, as well as securing criminal charges against the individuals, who are now facing the consequences of their actions.

“I hope this sends a clear message: anyone involved in this kind of scam, or trying to cheat the financial system, will be brought to justice."