Retailers and hospitality firms set for business rates ‘double whammy’

September’s 0.5% inflation rise means business rates will surge by £159.42 million in England next April.

Retailers and hospitality firms are set for a “double whammy” blow next year as September’s rise in inflation will spark a near £160 million hike in business rates, experts have warned.

The hard-hit retail, leisure and hospitality sectors have been given a one-year business rates holiday to help weather the pandemic, but this is set to end on March 31 – just before the new rate kicks in on April 1.

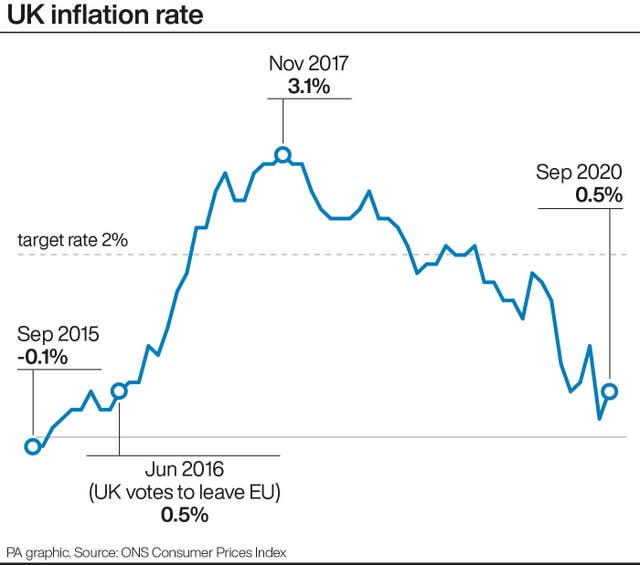

The increase in the rate of Consumer Prices Index (CPI) inflation to 0.5% last month means business rates will surge by £159.42 million in England next April, according to real estate adviser Altus Group.

It said £50.12 million will be shouldered alone by retailers in a painful “double whammy” for the sector.

Nearly 360,000 occupied retail, leisure and hospitality premises will return to full business rates on April 1 2021 after having had a £10.13 billion rates holiday in England this current financial year, Altus added.

Robert Hayton, head of UK business rates at Altus, said: “Government has an opportunity to disprove detractors, showing that the business rates system is in step with reality ensuring appeals to reduce property values because of Covid are accepted quickly, and at the same time, injecting additional targeted financial support to where it is needed most.”

The Government confirmed earlier this month that the next revaluation of business rates on shops and business premises will be postponed until April 2023, but this has disappointed many who are calling for an urgent overhaul of the system.

The September CPI figure is also used each year to calculate the increase in state pensions and benefits, though pensions are protected thanks to the triple lock guarantee.

State pensions will rise by 2.5% as it guarantees to increase by the highest figure out of CPI, earnings growth for the year to July, or 2.5%.

The Trades Union Congress (TUC) said a 0.5% rise for state benefits, such as Universal Credit, “will not be enough to get families through the tough year ahead”.

It has called for a rethink, given that “these aren’t normal times”.

TUC general secretary Frances O’Grady said: “That’s why we’re calling for an increase in the basic amount of Universal Credit to £260 a week.

“And the Chancellor should not wait until April. He should bring in the rise early as families need that support now.”