Bank of England policymaker says Brexit uncertainty still poses risk to UK outlook

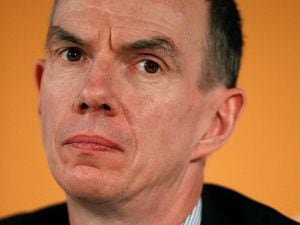

Sir Dave Ramsden was one of two MPC members who voted to keep rates at record lows of 0.25%.

One of the Bank of England’s newest policymakers has used his first speech to defend his dissenting vote against the most recent interest rate rise, adding that Brexit uncertainty still poses a significant risk to the UK’s economic outlook.

Sir Dave Ramsden, deputy governor for markets and banking, was one of two Monetary Policy Committee (MPC) members who voted to keep rates at record lows of 0.25% earlier this month, amid fears over muted wage growth and doubts over the Bank’s forecast for domestic inflation pressures to pick up.

“That was not because I disagree with the overall framework for setting monetary policy in this exceptional period, but rather because I have a somewhat different assessment of the economy,” Sir Dave said in a speech prepared for the Strand Group Lecture Series at King’s College London.

While the remaining seven members of the MPC moved to counter surging inflation with the first rate rise in a decade, Sir Dave said he was “willing to wait for more evidence on the evolution of wage and domestic cost growth before beginning to withdraw more monetary stimulus”.

“So I voted for no change in Bank Rate,” he explained.

“The biggest risk I see to that outlook for demand is around the resolution of the current uncertainty about our eventual trading arrangements and the path that will be followed to reach them.

“Were that uncertainty to be lifted, I can see a case for why whole economic demand could grow more strongly, more in line with, for example, recent manufacturing indicators.

“Equally, were uncertainty to persist at current levels or even increase further, I could see a case for demand growth, and in particular investment growth, being weaker.”

That potentially weaker outlook may also explain why wages have failed to keep pace, Sir Dave said, suggesting that workers may be less willing to push for higher pay in light of Brexit.

“I attach some weight to the idea that workers have responded to the changing outlook by showing greater flexibility in their wage demands.”

Fellow MPC member Ben Broadbent last week stressed that the Bank of England cannot be expected to delay interest rate hikes in light of Brexit.

He said markets have put too much weight on Britain’s divorce from the EU when it comes to considering whether an interest rate rise is appropriate, and said there was a “strain of opinion” that Brexit alone is a reason to “avoid” a hike.

“If so, then I think the belief has been overdone.”

While Mr Broadment said additional hikes are not inevitable, he has noted that he expects a “couple” of further increases as part of measures to get inflation back on track and closer towards the Bank’s 2% target.

Sir Jon Cunliffe, who was alongside Sir Dave in voting against the November rate hike, said earlier this month that the Bank should wait for signs of rising wage growth before pulling the trigger.

He said the Bank may be blindly relying on economic models which predict that wages will rise in response to lower unemployment, leaving it at risk of overestimating domestic inflationary pressure, as the recent spike in inflation has primarily been linked to the effects of the Brexit-hit pound.