Acenta moves forward with £23m financing

Steel processing firm Acenta, which has two major sites in the Black Country, is set for continued growth after sealing a £23m refinancing deal with HSBC.

Acenta Steel is one of the UK's leading processor and distributor of hot rolled and bright engineering steel bars and is working with HSBC and HSBC Global Receivables Finance.

HSBC's refinancing package will allow Acenta to continue to offer its portfolio of highly differentiated products for a range of sectors, including the hydraulics and automotive sectors.

The £60m-turnover business operates from six UK sites, including Willenhall and Dudley, and exports over 40 per cent of its steel to global partners.

The refinance will allow Acenta to continue to invest in stock and capital to maintain its position as the number one processor of bright bar in the UK and to provide one of the broadest product ranges of engineering bar in Europe.

Bright bar is precision finished material for component manufacture in wide ranging and demanding engineering applications such as engine, driveline and suspension parts, hydraulic valves and household goods.

In addition to processing steel, Acenta says it has a unique vertically integrated supply chain providing stock-holding, cutting and distribution facilities from a UK nationwide footprint.

It has additional operations in Rugby, Manchester, Newport, Sunderland, and Southampton.

HSBC's refinance ensures that Acenta can continue to deliver its comprehensive range of steel in niche grades and sizes for its domestic customers.

The business also aims to build on its existing international footprint in Europe and the United States and export wider to Mexico, Eastern Europe and Asia.

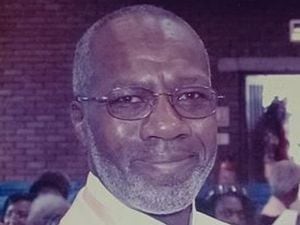

Colin Mills, chief operating and financial officer, said: "Long-term partnerships are key to our business model and the wider steel sector.

"As such, we needed an asset-based lender with strong credentials and a leading international presence. Refinancing with HSBC means we can focus on growing our business in the UK and overseas, with the financial support of a well-connected and established bank."

Paul Turk, area director for corporate banking in the Black Country, Shropshire and South West Midlands for HSBC, said: "Our international footprint fits well with Acenta's international growth plans, meaning we can provide both the connections and insights which will support the business's continued development abroad.

"HSBC Bank and HSBC Global Receivables Finance are delighted to be able to provide facilities for such a prestigious local steel business with a global outlook.

"This deal is a great example of the support we're able to provide to businesses in the region, helping rebalance the UK economy outside of London and connect businesses to international markets.

"As HSBC is an acknowledged market leader in export finance, we are perfectly positioned to support the future aspirations of Acenta Steel with an all-encompassing asset based lending facility."

The funding for Acenta was arranged by Gary Riley, relationship director for corporate banking at HSBC in the Black Country, and Graham Hay, corporate manager at HSBC Invoice Finance.